Part Three: Shocker at the Department of Insurance

Bob Woodward met his Deep Throat in the middle of the night . . . in a parking garage. I met mine on the telephone.

Bob Woodward met his Deep Throat in the middle of the night . . . in a parking garage. I met mine on the telephone.

But they both used the same technique. Neither of these informers would openly disclose the problem. Both would say, “I won’t offer to tell you anything. It’s up to you to ask the right questions.” The Watergate Deep Throat fed Bob Woodward enough leads to collapse the Nixon administration. My Deep Throat had given me enough information to suggest that the South Carolina Department of Insurance might not be regulating our homeowners insurance. Was that possible? The only way I could answer that question would be to interview the actuaries at the Department of Insurance, or D.O.I.

I placed a call to Leslie Jones, the D.O.I. Deputy Director for Property Insurance. When she answered, I simply said, “Ms. Jones, I am a businessman from Beaufort. I have an interest in researching how our coastal hurricane risk impacts the homeowner insurance premiums along the coast. Would you mind if I met with your property actuaries? I have no dog in the hunt. I simply want to understand how our coastal hurricane risk impacts the rate making process.”

Ms. Jones was very cordial and gave me the go-ahead to set up the appointments.

Deep Throat had thrown me enough bones to know the questions I needed to ask. First, does D.O.I. understand our basic coastal risks? For example, do they know that North Carolina has a higher coastal hurricane risk than South Carolina? Second, do they know that Horry County has a higher risk than Beaufort County? Third, when the department receives a requested rate increase, do they bring in an outside team of specialists to examine the complex hurricane models that support the increased premiums?

The first actuary that I met could have been my son. He was in his late 20s, bright, friendly, and clearly motivated to do a good job. But within thirty minutes he began to scare me. I first asked him what his understanding was of the hurricane risk along our coast. For example, I asked, is the hurricane risk greater or lower in Beaufort County compared to Horry County? He quickly replied, “I believe the risk is higher in Beaufort County.” He was dead wrong. My research showed just the opposite. It is less risky in southern South Carolina. I later discovered how important this question was. On a coastal state average, projected hurricane damage makes up 75% of all base insurance costs. This is the “cost of goods sold” element for determining our homeowners’ premium. Once the insurance company knows this base cost, they add operating cost and profit to arrive at the requested insurance premium. Thus, if we know that Beaufort and Jasper Counties have a relatively low risk for hurricanes, homeowners’ insurance premiums should be lower than those in North Carolina, Florida, and all of the gulf states.

I asked this young actuary if they contracted with a team of specialists to examine the complex support material and software that accompanies the major requests for rate increases. His answer was shocking. “No,” he said, “But we would like to. Instead we usually call Florida and ask them their opinion of the model that the catastrophe modeling companies used.”

Before I left, I asked for a copy of the rate plans that the insurance companies had filed for the coastal counties. Ten companies filed plans that had the same homeowner premiums from North Carolina to Georgia. This should never have happened. The hurricane risk is higher in Horry County. The rates should also be higher. Simply put, this young man had just told me that the State of South Carolina has not been regulating homeowners insurance. It cannot, unless it tears apart the complex computer models that support the rate increase.

I know from my experience in running Citizens Utilities that one way a company can raise its profits is to pass expenses to the rate payer that should not be passed to them. When I interviewed the second actuary, I asked him this question: “What are your guidelines as to what expenses you allow to be included in a rate case? He replied, “Let me give you an example of what we allow. I have an expense here that an insurance company is asking us to include in their rate increase. It’s for our share of the expenses that were generated when the insurance company conducted a training class in Florida.” I quickly responded, “How many of your staff attended this training class?” He replied, “None.” “Then why would the South Carolina tax payer pay for an expense that had nothing to do with our state?” His reply? “Because we have always done it that way.”

I was faced with a real dilemma. My interviews told me that there was no way that the D.O.I. could regulate homeowners insurance. If they do not have the capability of challenging the underlying rate case assumptions, they can’t check anything. The interviews told me one other thing. FOR THE LAST EIGHT YEARS, THE INSURANCE COMPANIES HAVE KNOWN THAT OUR COASTAL HURRICANE RISK WAS RELATIVELY LOW. YET, OUR OWN DEPARTMENT OF INSURANCE HAS NOT KNOWN THAT. I could not believe what I heard. I had to have someone check my understanding of the facts. And they also had to check my conclusions. Maybe I had missed something.

I knew the type of person I needed to check my conclusions. He or she would have worked in a state department of insurance in the past as an actuary. Ideally, that person would also have had the experience of being an rate case expert for other states. And if I were really lucky, that person would also be one of the few experts who could evaluate the complex hurricane models that insurance companies submit to back up their rate increases. I got lucky. Martin Simons met all of these requirements. He was actually on the South Carolina actuary staff in the 90’s. He left and started his own rate case witness business. Today, he is considered one of the nation’s most knowledgeable independent rate case witnesses. And he is on the hurricane expert review teams for Florida, Hawaii, and Maryland. I gave Mr. Simons a call.

When he answered, I gave him a one minute summary. This is my background. I interviewed three actuaries. I need your help to critique what I think I saw. Quite frankly, I cannot believe what I saw. Can you help me? Instead of saying, “Let’s talk,” he said, “Can you meet me in Charleston next Tuesday at a restaurant at 12:30?” I replied, “Of course. I am honored that you would drive to Charleston to meet with me.”

I entered the Charleston restaurant at 12:25pm. The maître de quickly pointed me to the table where Marty Simons was seated. As I approached his table he stood up before I could extend my hand in friendship. He immediately said, “Mr. Ferguson I know exactly what you want to know.” I said, “Mr. Simons, how could you possibly know what I want to know? I only had a short conversation with you.” Marty then replied, “Mr. Ferguson, I know your background. If you met with three of the D.O.I.’s property actuaries you want to know one thing from me. Why doesn’t the State of South Carolina regulate homeowner’s insurance?” I sat down in complete shock. This man just read my mind.

I had one obvious follow-up question. How did this happen? Who allowed it to happen? Who opened the gates to the insurance industry? In a quiet voice Marty said, “I don’t really know. It had to come from either the governors or the legislature. But I know one thing. In the eighteen states that I provide expert rate case testimony, South Carolina is seen as having the weakest regulation of insurance.”

Marty Simons is a rare individual. He speaks openly and with confidence because he knows his subject matter better than anyone in the industry. States hire him as an independent witness because of his knowledge and candor, not because of his good looks. It would be my guess that this honesty has probably offended a few bureaucrats along the way. But that is exactly what makes him so special and so valuable.

After an hour and a half, we were both ready to leave the luncheon table. I made some comment like, “You really helped me see why the state does not regulate homeowner’s insurance.” Marty quickly fired back. “I have given you answers to part of the puzzle. However you will not see the entire problem until you talk with Elliott Elam.” “Who is Elliott Elam,” I asked. “He is the Consumer Advocate of the State.” Then I asked Marty, “What am I going to learn from Mr. Elam?” Marty answered like a Deep Throat. “Daryl, that is for you to find out.”

The next day I called Elliott Elam. After introducing myself I shared with him Marty Simons’ comment. Elliott opened up. He said, “Daryl, the legislature passed a little known law in 2004 that literally gives the insurance companies the right to get an automatic rate increase as long as they keep that increase to 7% or less. The D.O.I. has the after-the-fact right to challenge such increases. However, they rarely do.” Furthermore, he said, the insurance companies tend to shift the majority of each rate increase to the coastal counties. I asked him to give me an example of such a request. He said, “Not long ago State Farm sent a request to the D.O.I for a 90% increase in a rider to their homeowner’s insurance policies. They sent me a copy of this increase and asked for my comments. I immediately called State Farm and asked them to send me the supporting material. As soon as I asked for it, they quickly said to me, “Oh forget the rate request to the D.O.I. We will just file the rate increase under the 7% rule.”

I could not believe what I was hearing. First, the D.O.I. has not trained their actuaries to know how hurricane risks differ throughout our state. Second, they have no way of challenging the complex hurricane models that support the rate requests. And finally, the state allows any insurance company to get a near automatic rate increase.

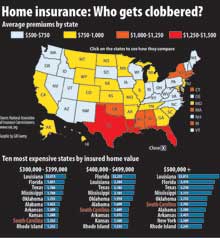

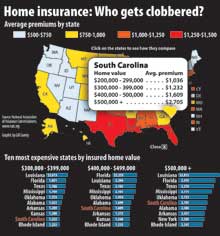

I know one thing; if I were the president of one of those major insurance companies, I would be hearing one statement repeatedly at the coffee table. SOUTH CAROLINA IS A HONEY HOLE FOR RATE INCREASES. How has this lack of regulation impacted the average rate payer? Last summer, The Charleston Post and Courier started a series called “Storm of Money.” It took the data from my research and expanded it. Under the guidance of an exceptional reporter, they issued this report in their opening edition. It shows that South Carolina residents pay some of the highest homeowner premiums in the nation. However, this chart only compares “average” state premiums for each value range of homes. My strong guess is that if this chart showed how our average coastal county premiums compared to that of other coastal states, we would rank near the top.

Footnote: On June 4, 2012 the Charleston Post and Courier started the series, “Storm of Money.” The series is based on Mr. Ferguson’s original research. In their first story the newspaper reported that the Department of Insurance (or D.O.I.) has not been using an outside team of experts to critique the insurance company hurricane models. These are the models that insurance companies use to support their rate increases. Three months later the D.O.I. announced that they would contract with such a team to exam their recent rate cases.

In our next issue:

The Department of Insurance is not interested. The governor is not interested. A team of advocates comes together. The Post and Courier digs into the problem. And what they discover is alarming.

Daryl Ferguson has lived in Beaufort Country since 2000. He is the past President of Citizen’s Utilities, America’s largest multi utility, and former Chairman of the Board of Hungarian Telephone and Cable, its second largest communications company. Daryl holds a PH.D in Business and two patents.