Part Five: Governor Haley, Missing in Action

By April of last year I knew we had a sizeable homeowners insurance problem. Our premiums were among the highest in the nation. An insurance industry insider had secretly given us the numbers that showed that our risks were “relatively low.” By that time we believed that we had identified most of the problems.

By April of last year I knew we had a sizeable homeowners insurance problem. Our premiums were among the highest in the nation. An insurance industry insider had secretly given us the numbers that showed that our risks were “relatively low.” By that time we believed that we had identified most of the problems.

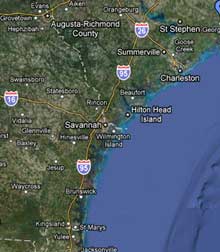

The biggest one was that the Department of Insurance was a passive group that historically lacked strong leadership. Because of this they were not doing their job – regulating homeowners insurance. Later in the summer we would discover just how big the problem was. But in early April we knew we had a big problem. Our best estimate at the time was that the taxpayer was probably being over-billed by 30-50%. Maybe more important, our Beaufort County realtors were beginning to tell us that they were losing customers once those customers realized how much they’d have to pay in homeowners insurance.

But spotting a large problem is not enough. It is also not enough to discover that our coastline has the best fall weather in the South. We needed a plan to address these problems and opportunities. We needed to figure out how to lower homeowner premiums. We needed to inform tourists that we’re not a magnet for hurricanes. This would require a team of experienced business and government leaders to get together and do the tough work . . . develop solutions. I started asking, “Who in the county and the state has the experience and interest to diagnose and solve complex problems?” Almost immediately a dozen of the same people were frequently mentioned: Stu Rodman (County Council member and business owner), Andy Twisdale (civic leader and top Hilton Head realtor), Tom Davis (Republican state senator and real estate lawyer), Terry Ennis (retired DuPont executive and economic planner) and David Ames (developer of Long Cove Plantation ). This was our initial team. By the late summer we had an extended group of associates that included David Tiggis (CEO of the regional McNair Law Firm), Gary Kubic (County Administrator), and Larry Rowland (historian, teacher, and visionary). By fall Vince Sheheen, Democratic state senator, informed us that our state insurance problem was a bi-partisan and state-wide concern. He joined our extended team.

Andy Twisdale brought a special skill to the group. As a realtor, he was on the front lines of knowing how competitive we are in attracting out-of-state retirees to Beaufort County. Andy’s interest in our group was sparked by this sensitivity. A retiring attorney from Chicago had just informed him that he was no longer considering Hilton Head as his retirement destination, having discovered that our annual homeowners premiums were “prohibitive.” Andy put his concern into action. By September, we had formalized our group as the South Carolina Competitive Alliance. Our mission was to assist the state and its taxpayers in spotting problems and developing solutions that would make the state more competitive. We elected Andy as our chairman of the board.

This team went to work. Within a few weeks we had developed the framework of a plan that we believed would address our problems. To improve the regulation of the Department of Insurance, we clearly needed to search for a candidate with stronger proven leadership skills. First, we had to identify those skills. The state had to rescind the little-known law of 2004 that allowed insurance companies a near-automatic implementation of rate cases. (This law was a clear message to any insurance company that South Carolina would “go easy” on them.) The D.O.I. had to agree to hire an independent team of experts to tear apart and critique the complex computer models that insurance companies used to support their rate increases. And the D.O.I. had to restructure its entire rate zones for every homeowner. Now that we knew insurance companies could set rates by the house, why would we ever want zones set that were identified by a straight line? We needed to establish homeowner rates by a common risk area.

Our most critical problem-solution was the need to upgrade the qualifications for the next Commissioner. David Black resigned the position in December of 2011 for undisclosed reasons. The position had been open for six months. We knew that the governor was looking for a replacement, and that replacement had to be stronger. How much stronger? We believe that we need a commissioner who has had the leadership responsibility that goes with running a middle-to-large-sized business. Usually that person has a budget responsibility of 200 million to one billion dollars. Why is this so important? Because the Department of Insurance regulates an annual insurance premium of over three billion. Large responsibilities require someone who feels comfortable and confident dealing with sizeable problems and systems. An insurance agency head, for example, would not have the faintest idea how to deal with complex turnaround issues. More important, our group believes that it will take more than tighter controls to regulate the insurance company. We will need a commissioner who is able to comfortably negotiate with the top management of insurance companies. We want the insurance industry to succeed. But they need to be successful by being more entrepreneurial… not by just raising their prices and reducing our benefits.

Last May our immediate challenge was to meet with the governor before she appointed the next Commissioner of D.O.I. Everything depended on the governor understanding the depth of the problem and why she needed to look for a more skilled leader. Time was our enemy, but I took some comfort in knowing that most state governors are very willing to meet with business leaders when there is a significant problem. The common thread is the economy. A governor’s success depends on healthy businesses. The larger businesses, in particular, know this. If they see a state-wide problem that is going to affect them, they know it could also have some impact on their financial health . . . and the number of people they employ. Last May our unemployment level was over 8.5 %. We still had a weak economy. Most of our neighbors were hurting. The governor had already stated that unemployment was her number one concern.

When Governor Haley was inaugurated she made this statement, “I challenge the business community to help me make the state more competitive. I also challenge them to help me make state government operate more like a competitive enterprise.” That was exactly what we were doing. In my mind, if we send the governor a letter requesting an appointment, someone from the governor’s office will be calling us tomorrow. We should be able to see the governor within a week or so. In my experience, that would be the normal response to a group of experienced business people. That never happened.

It was now mid-May. The Post and Courier had just informed us that their first article on the state’s homeowners insurance crisis would be printed on June 4. At that time we had no idea what investigative reporter Tony Bartelme would write. But we did know that it was likely to be very critical of the state’s D.O.I. Although we could never get an appointment with Insurance Commissioner Black, we did not want this Post and Courier series to embarrass the governor. We needed the governor to be part of the solution, not part of the problem. On May 25, the five of us (Twisdale, Rodman, Ennis, Ames, and myself) signed a letter addressed to Governor Haley. We informed her that the Post and Courier would be publishing a series on the insurance crisis. We also told her that we had specific ideas about how she could both acknowledge the problem and publicly show leadership. Then, we asked her to meet with us as soon as possible. That never happened. What did happen was a very apparent effort by her office to “manage” the situation.

After two weeks had passed, we had not heard from the governor’s office. I then placed a call and reached a junior staff employee. She had no record of our letter. However, she informed me that we would have to be “vetted” before they would consider setting up an appointment. That really surprised me. The governor’s office might not know me, but they certainly know Stu Rodman and David Ames. And by simply consulting the internet, they could certainly read my bio. The next day Mr. Josh Baker called me. He informed me that he was an aide to an aide and that he would be glad to “vet” us in Columbia the following week. We started our meeting with Mr. Baker by showing him the size of our homeowners insurance problem. Then, we shared with him our understanding of the problems behind our high insurance premiums. Finally, we outlined our recommendations. Most important, we communicated a sense of urgency. The governor needed to meet with us as soon as possible. She needed to understand the skill requirements necessary for our next commissioner of insurance. We did not connect. Mr. Baker’s only response was, “The governor was very busy . . . working on the budget, ethics committee, etc. The D.O.I. is short staffed . . . ” David and I thought, “So, what? If the problem is huge and our taxpayers are being unfairly hurt, let’s find a way to meet and solve this problem. And quite frankly, if the governor is too busy, she can always ask a senior aide or a cabinet member to step in and help her address the problem.”

After ninety minutes of discussion that was going nowhere, Mr. Baker rose from his chair and said, “Gentlemen, thank you for coming. I will get back to you. I am late to another meeting.” That is all he said. But before he left, I knew that I had to say something that would get his attention. It had to be something that might be relayed to the governor. So, I became a little louder and little more forceful. “Mr. Baker, before you leave I think there is one message that we would ask you to relay to the governor. When Governor Haley was elected, she challenged the business community to help her make the state more competitive. A group of us have done just that. We have put thousands of hours into identifying a huge problem that is hurting both our residents and our ability to compete as a state. Furthermore, as businessmen, we have developed possible solutions. Please inform the governor that if she does not meet with us, the state’s business community will most likely believe that we have a governor who really doesn’t mean what she says.”

I realized this statement was somewhat inflammatory. But the problem was too big and too critical to be allowed to die on the vine.

Mr. Baker never called back. The five of us continued to contact anyone we knew on the governor’s staff. But neither the governor nor any senior aide was available to see us. In the meantime the Charleston Post and Courier released its series of Storm of Money articles during the summer of 2012. They had uncovered a much darker picture of our homeowners insurance problem. The state’s average homeowner’s premium ranked among the highest in the country. The insurance industry made its highest profit in homeowners insurance in South Carolina. And the newspaper had interviewed a whistleblower from Allstate who said his company had been manipulating the claims that they pay out. The Post and Courier had connected the dots.

The ice started to crack in August. Andy Twisdale got a call from Katherine Veldran, a senior aide to the governor. Andy knew Katherine and considered her a very professional and honorable person. He trusted both her ability and wisdom. Katherine gave Andy one message, “Be patient. Work with me, and I will get your team in front of the right people.” That message was encouraging, but it was also strange. There were no “right people.” It was only the “right person.” Only the governor could help us. Only the governor would search out and appoint the next commissioner of insurance.

We put our hopes in Ms. Veldran. We sent her volumes of material that supported our position. Still, we got no call that said “the governor will see you.” However, in mid-November, Katherine called both Andy and me and said that the governor had selected Mr. Ray Farmer as her next Commissioner of the Department of Insurance. His background? He had been a senior lobbyist for the insurance industry for the last 33 years. To say we were shocked would be a huge understatement! We had tried to meet with the governor for five months and had received no response. Why would the governor reach for an insurance industry lobbyist at a time when the insurance industry is making its highest profit in South Carolina . . . an obscene 20% of net worth? Why would she choose someone who has none of the skills needed to turnaround a large and complex problem? How would she even know that a soon-to-retire lobbyist was available to be hired? And why wouldn’t she meet with a group of businessmen who had taken the time to address her personal challenge?

On November 13, 2012, the governor announced to the Press that she had selected Mr. Ray Farmer as her next Commissioner of Insurance. She noted that she wanted more than a lawyer or a former legislator. She wanted a businessperson. But Mr. Farmer was not a businessman. He had never been a businessman. For the last 33 years he had been a senior lobbyist for the insurance industry.

I could not have been more proud of our team. After a few days of depression and mourning, we agreed to make the best of the situation. Maybe Mr. Farmer was stronger than his resume suggested. Maybe he had some inner drive to work as closely with the state’s consumers as with the insurance industry. If he was interested, we could help him. There was only one way to find out. We had to meet him.

We did not have to wait long for that meeting. In early December Ray Farmer called and invited Andy Twisdale, Stu Rodman and me to meet with him. Mr. Farmer is a very congenial and easy-to-meet man. He has a way of putting you at ease almost immediately. That’s a good skill and it probably comes from being a lobbyist. Mr. Farmer started the meeting by noting that he respected our position and our concerns. He noted that we probably had the same goals – to help the state and its consumers and businesses succeed. Then he asked us for our thoughts. Andy Twisdale was brilliant. Instead of going through a thirty-minute presentation, he simply showed two charts. The first one showed that the average residents were paying some of the highest premiums in the nation for homeowners insurance. The second chart showed that the insurance industry was making its highest profit in the nation for the insurance in South Carolina. Andy simply said, “This is our problem . . . and it is hurting our homeowners and our ability to compete as a state.” When the meeting ended, Mr. Farmer said, “Let’s get together and solve these problems.”

We did not have to wait long to see if Mr. Farmer had the willingness to represent the state’s consumers as well as the insurance industry. The very next day the Post and Courier interviewed him. His answer to one question was very revealing:

Post and Courier: ” Mr. Farmer, home insurance rates are among the highest in the nation and especially on the coast. Are they too high?”

Answer: “We haven’t heard an outcry. Pick any kind of a product. As a consumer I’m going to say that I am paying too much for a product. But the question is whether I’m getting value for what I am paying, and I think the answer is yes.”

A letter to the editor of the Post and Courier captured the moment this way:

“Congratulations Governor Haley. You just put the fox into the hen house.”

In the next issue:

The Senate changes history when it reviews the nomination of Mr. Farmer. Senators Davis and Sheheen define bi-partisanship. Senator Davis gets a commitment that no one else can get.

Read Billion Dollar Coastline: Part One

Read Billion Dollar Coastline: Part Two

Read Billion Dollar Coastline: Part Three

Read Billion Dollar Coastline: Part Four