Part Six: Disappointment and Exhilaration

There is no more painful task than to make the case that someone is not qualified for a job . . . especially when the applicant, or nominee, wants the job. Ray Farmer wanted the job. He wanted to be the next Commissioner of Insurance for South Carolina. But by any objective test, he was not qualified.

There is no more painful task than to make the case that someone is not qualified for a job . . . especially when the applicant, or nominee, wants the job. Ray Farmer wanted the job. He wanted to be the next Commissioner of Insurance for South Carolina. But by any objective test, he was not qualified.

In business, we frequently run up against this situation. The decision gets more difficult if the candidate is likeable. However, businessmen and businesswomen usually apply this test. We ask ourselves, “Is this person likely to have a positive effect on the organization, and the other employees, or is this person likely to just tread water?”

In our opinion Ray Farmer had none of the skills required to bring a level of equilibrium to our insurance rates. Before our team requested to meet with the governor to alert her to our insurance crisis, we developed a list of possible solutions. One of the most important recommendations was to upgrade the requirements for the position. With few exceptions, past governors had nominated insurance commissioners who either had limited skills or had a background that did not make them “independent” leaders. How, for example, could an existing owner of an insurance agency fairly rule on a rate increase that would be sold by the commissioner’s own insurance agency? Thus, we’d wanted to meet with the governor in advance of her selection of the next commissioner of insurance. We’d hoped to show her that she should be searching for a candidate that had these skills:

* Strong Leader

* Experienced Operations Officer

* Goal-oriented

* Proactive

* Completely independent

* Experienced negotiator at top management level

* Turnaround experience

What this list basically said was the following: Let’s appoint a commissioner who has the past experience to work at solving problems at the $3.0 billion dollar level. Why? Because that is the annual size of our state insurance premiums. And a person who has had that level of experience will also have the experience to turn around the serious problems surrounding the Department of Insurance. Would we be able to attract candidates who have that experience at a modest state salary? Our answer was definitely YES. South Carolina is a magnet for retirees who recently retired from running medium to large size corporate divisions. Many of these talented retirees still have a “fire in their belly.” And many of them want to give back to their community.

In reviewing Ray Farmer’s background, we knew one thing. He had, in our opinion, none of the required skills to turn around the Department of Insurance. He’d been a lobbyist for the past 33 years. He certainly had excellent communications skills. He should. That was his job. But he had not run a sizeable profit and loss center. He had no experience working with top management of a large corporation. How could he possibly negotiate with them? While he certainly had an interest in providing good customer service, he had no experience in how to do it. And probably most significant, he was certainly not independent. At a time when the insurance industry received their highest profit from homeowners insurance in South Carolina, did we really want the leader of our Department of Insurance to come from the ranks of insurance lobbyists? Absolutely not.

Ray Farmer demonstrated his lack of leadership skills during the first ten days on the job. Ten days after the governor appointed him as her next Commissioner of Insurance, he agreed to be interviewed by the Post and Courier. I know of no one in business who would do that. A leader of any new business division would want at least ninety days before giving an interview to a newspaper. You simply need that length of time to really triangulate on both your major problems and likely solutions. You might have a feel for your problems in ten days; but you almost certainly will not have enough facts and observations to make any firm statements. But that is exactly what Mr. Farmer did. The Post and Courier asked Mr. Farmer two questions, in particular, that illustrated his lack of interest in getting behind the facts:

Post and Courier: “Home insurance rates are among the highest in the nation and especially on the coast. Are they too high?”

Farmer: “We haven’t had an outcry. Pick any kind of a product. As a consumer I’m going to say that I’m paying too much for a product. But the question is whether I’m getting value for what I’m paying, and I think the answer is YES.”

Post and Courier: “How satisfied are you with customer service right now?”

Farmer: “We’re good, but with anything else, we can always do better. That’s why we’re going to expand the hours.”

Andy Twisdale, Stu Rodman, and I met with Mr. Farmer on December 10, 2012 and shared our views on the homeowners insurance crisis. At that time he invited us to meet with him again for a more detailed discussion. Two weeks later I met with Mr. Farmer for the second time. Again, I saw a friendly, affable, and welcoming man. But I did not see a businessman. And I did not see a strong leader. For example, I asked Mr. Farmer how he intended to meet the governor’s goal of “improving customer service.” His response? “I intend to give the Charleston office more hours. We will improve our web site. And I intend to assign one of our staff people to periodically meet with customers.” He asked what I thought of that approach. My answer was, “Ray, customer service for the D.O.I. will start with you. You will be the one who has to set the new customer service culture. If I were you, the first thing I would do is to use one day each week to simply meet with customers throughout the state. Make no speeches. Do not invite the press. Just listen to their concerns. After doing this for a month, require every one of your supervisors to do the same thing. After a couple of months the entire department will come to agreement on your major customer concerns. Now you have a good starting point for making improvements.”

After this meeting I had a deep personal concern for Ray Farmer. It was crystal clear that he did not have the critical skills necessary to run the Department of Insurance. But he was a nice man with a fine family. Somehow, he was led to believe that he had the skills for this job simply because he had tenure in one part of the insurance industry. Ray’s strength was his ability to communicate. He was never in a position to develop strong leadership and problem solving skills. He clearly had very little knowledge of risk analyses.He had not interfaced with the top management of any insurance company. So, how could he possibly be expected to negotiate with the top management of insurance companies? It was clear to me that Ray Farmer was on a course of almost certain failure. His appointment would be similar to that of a major hospital hiring an experienced medical equipment salesperson as their next chief executive officer (CEO) simply because that person “came from the medical field.” It was clear to me, and our team, that Ray Farmer was not qualified for this position. But none of us wanted to see this man hurt because he had accepted a job that was over his head.

We were now as concerned for the personal welfare of Ray Farmer as we were about having an unqualified commissioner. Our one hope was the Senate’s Committee on Banking and Insurance. Once the governor selects a cabinet level nominee, she is required to submit the name to the committee and get its “advice and consent.” It was our hope that the committee dialogue would be sufficient enough to cause the governor to withdraw Mr. Farmer from nomination. Or it might even urge Ray Farmer toward some introspection and cause him to withdraw. That was our hope. But we were very naive. What I soon learned was that in South Carolina, the state’s major legislative committees always approve the governor’s cabinet level nominees within fifteen minutes. They do this to show “deference (or respect) to the governor’s office.” But in a state where the past governors have traditionally hired weak commissioners of insurance, this “deference” only continues an ineffective hiring practice.

Two events happened to rattle this historical “rubber stamping” of the governor’s new nominee. One, Senator Tom Davis had been studying the insurance crisis for at least nine months. Unlike many legislators, he knew the coastal risk analyses so well he could challenge even the most knowledgeable insurance commissioner. He knew the weaknesses of the state’s 7% law that gave insurance companies a near automatic rate increase. As a member of the Senate’s Banking and Insurance Committee he was clearly one of the most insurance-educated senators. That was also true of Senator Vincent Sheheen, a Democratic leader from Kershaw. As early as last summer, Senator Sheheen had started to study the state’s homeowners insurance crisis. He’d also asked us to meet with the Democratic Caucus to help educate them. Senator Nikki Setzler heads the Democratic caucus, and had insisted that its members be more knowledgeable on the underlying problems. In other words, the first meeting of the Senate’s Banking and Insurance Committee to approve Mr. Farmer had at least two members present who were quite knowledgeable on the extent of our insurance crisis: Tom Davis, Republican, and Nikki Setzler, Democrat. And how senators Davis, Setzler and Sheheen worked together made me proud to be an American.

The Senate Banking and Insurance Committee met on January 23 to approve the governor’s nomination of Ray Farmer as Commissioner of the D.O.I. In the eyes of Chairman Wes Hayes, this meeting would probably take fifteen minutes. It took three weeks. Two weeks earlier I asked if I could attend and make a few comments. I was hoping for twenty minutes. I got the historical ruling. “Commenters get three minutes.” At the time I did not know that this meeting was understood to be a respectful rubber-stamping session. So, I proceeded to trim a twenty-minute presentation down to four minutes.

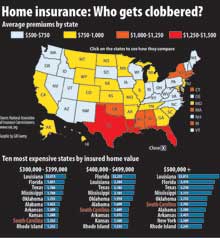

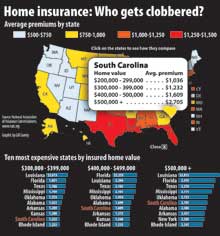

After the committee asked a series of routine questions of Mr. Farmer, they informed me that I had three minutes. I quickly focused on three small posters. One showed that South Carolina has some of the highest premiums in the country. The second poster showed that for the last ten years, the insurance industry has made its highest homeowners insurance profit in South Carolina – an astounding 22% return on net worth. The third poster showed how Mr. Farmer’s skills compared to those we believed necessary for the next commissioner of insurance.

It took me four minutes to make this abbreviated presentation. But it triggered questions that took another thirty minutes. During this thirty minutes, the committee would address one question to Mr. Farmer. Then, they would ask me to respond to the same question. Here an example of one question they asked Ray and me:

Banking and Insurance Committee: ” Mr. Farmer, how would you improve competition in the state so that we might have lower homeowner insurance premiums?”

Mr. Farmer, “I would improve the web site and approach more insurance companies to invite them to do business in the state?

Banking and Insurance Committee: “Mr. Ferguson, how would you develop more competition?”

Mr. Ferguson: “We will not become more competitive by inviting more insurance companies to do business in the state. We already have over 50 insurance companies offering policies. We have to ask ourselves this question: Why don’t insurance companies lower their rates, or offer new valued benefits, to get more business? Or why aren’t they more concerned with customer service? The answer is that they do not have to. Whatever rate increases they want, they get. They are lowering benefits and simultaneously raising their rates. No one is challenging them.

“To make them more competitive, we need to do three things. One, take away their easy path to rate increases. Cancel the 7% law that allows companies go get a near-automatic rate increase. Insist that the Department of Insurance hire an expert contract team to critique the complex computer models that support every rate increase. Second, re-set the rate of return range that we allow insurance companies to earn. Start by assessing the amount of over-billing that the industry has made over the last five to ten years. In all likelihood, the commissioner should probably ask for a reduction in state-wide premiums. However, this should be followed by developing a new rate of return range that will give insurance companies the ability to receive an above average return. But, they must show that they offer affordable policies backed by delivered claims and good service.

“Furthermore, every insurance company must show that they are offering premiums that relate to their own area’s projected risk area – not some straight line drawn by the D.O.I. Finally, let’s have all insurance companies use the same agreed upon number of common risk areas. Today, they all differ. Customers cannot compare one company to another because they all act like mattress retailers. Each company changes something, like a deductible percent, so you and I cannot compare anything. I would suggest that we ask all of them to set premiums on at least four or five common situations. Then, we can constantly compare them, as we would compare the base pricing of a mid-level Ford to a mid-level Toyota.”

The first day meeting of the Banking and Insurance Committee did not take the historical fifteen minutes. It took two hours. For the first time, the Banking and Insurance committee broke ranks with tradition. Each time the chairman asked if the committee was ready for a vote, committee members said, “No, we have more questions to ask.” Senator Setzler, in particular, spoke up and said, “For the first time in our history we are doing what we should be doing . . . doing our homework before we approve a cabinet level position. We need another meeting.”

One week later the committee convened for its second meeting. Most of their questions were for me. I outlined the depth of the problem in great detail. Then, I summarized the type of critical skills we needed for the next insurance commissioner. Finally, I went through more detail about why we needed a candidate who had the experience to solve these problems. You could easily tell how much was at stake for the insurance industry. There were at least thirty to forty insurance lobbyists in the hearing room. And they came from throughout the nation. The meeting evolved almost like a caterpillar evolves into a beautiful butterfly. Each time a question was asked and answered, the committee’s understanding of our insurance crisis advanced. By the end of the two hours, several senators made comments like, “I had no idea how serious this problem is.” A few minutes later a senator would say, “This committee has made real progress in understanding the problems.” At the same time, you could also see the frustration in their faces. They were breaking from tradition. Instead of blessing the governor’s selection, they were really challenging the nominee. Again, the committee asked for a third meeting. This was unprecedented.

During the third meeting, Senators Tom Davis (Republican) and Nikki Setzler (Democrat) led a turning point discussion. Up to this point, Mr. Farmer had acted more like a working lobbyist than a prospective new commissioner. He’d repeatedly said that our insurance premiums were not too high. He defended them by saying our higher coastal hurricane risk would cause such high premiums. And he defended the insurance industry by again saying that their profit was not too high . . . even if it was the highest in the nation. But during the third approval meeting, Senator Tom Davis did not accept his answers. Tom turned to Farmer and said, ” Mr. Farmer, my research shows me that our Charleston to Savannah coastline is ‘relatively low risk.’ That directly challenges your assertion that our high insurance rates are justified. Do you agree that we have a critical homeowners insurance problem along our coast?” Farmer paused for a long time. Then he responded, “I agree.” Davis continued: “I have talked with a broad range of homeowners along our coast. They do not understand why their homeowners’ premiums are so high if our coastal risk is relatively low. Our realtors do not understand why they are losing sales from retirees who no longer consider our coastal communities affordable. If you are approved as commissioner, will you commit to this committee that you will make our coastal insurance problem your number one priority?” Farmer responded, “I will make it my top priority.” Furthermore, if this committee decides to adopt legislation to further more competitive insurance rates, will you support our action?” Again Mr. Farmer paused and said, “Yes, I will.” Tom Davis had just turned Mr. Farmer upside down. Farmer had moved from saying that the state does not have a problem to saying that it does. And he’d moved from discounting the coastal insurance problem to making it his number one priority.

In the process, Senator Nikki Setzler had noted that the Banking and Insurance Committee had just made history. It had not rubber-stamped the governor’s nomination of Mr. Farmer. Instead, it had met for three weeks to better understand our underlying insurance problems and the qualifications of Mr. Farmer. Senator Setzler went on to say that he intended to recommend that this type of in-depth review of prospective cabinet level nominees be the new standard for South Carolina. In the end, the Banking and Insurance Committee approved the governor’s nomination of Mr. Farmer . . . but not before they got Mr. Farmer to make coastal homeowners insurance his top priority.

It was strange for me, personally. I was both saddened and exhilarated at the same time. I was disappointed that the committee had felt bound by history to approve a very weak candidate. I was exhilarated to see the two state political parties work so well together. Washington should take notice.

WE WANT YOUR COMMENTS. What has been your reaction to this Billion Dollar Coastline series so far? How important is the homeowners insurance problem to you? What are your ideas? What are your thoughts? Please e-mail, or mail, us your comments by April 10. We will publish a cross section of the comments that we receive. Address your comments to editor@lcweekly.com