Part Four: A Double Barrel Problem

How big is our insurance problem?

How big is our insurance problem?

By August of 2011, I knew we had a sizeable homeowners insurance problem. But that soon became just the tip of the iceberg. My insurance industry “deep throat” had suggested that we have the potential to lower our premiums by 30-50%.

Each year South Carolina residents write homeowners insurance checks that total $1.2 billion dollars. State businesses pay approximately $400 million each year for the equivalent insurance. Together, we pay the industry $1.6 billion a year for “homeowners insurance.” With a 30% reduction we would be putting almost a half a billion dollars back into our economy. And we would give back to every homeowner approximately $400-$800… depending upon the value of the home.

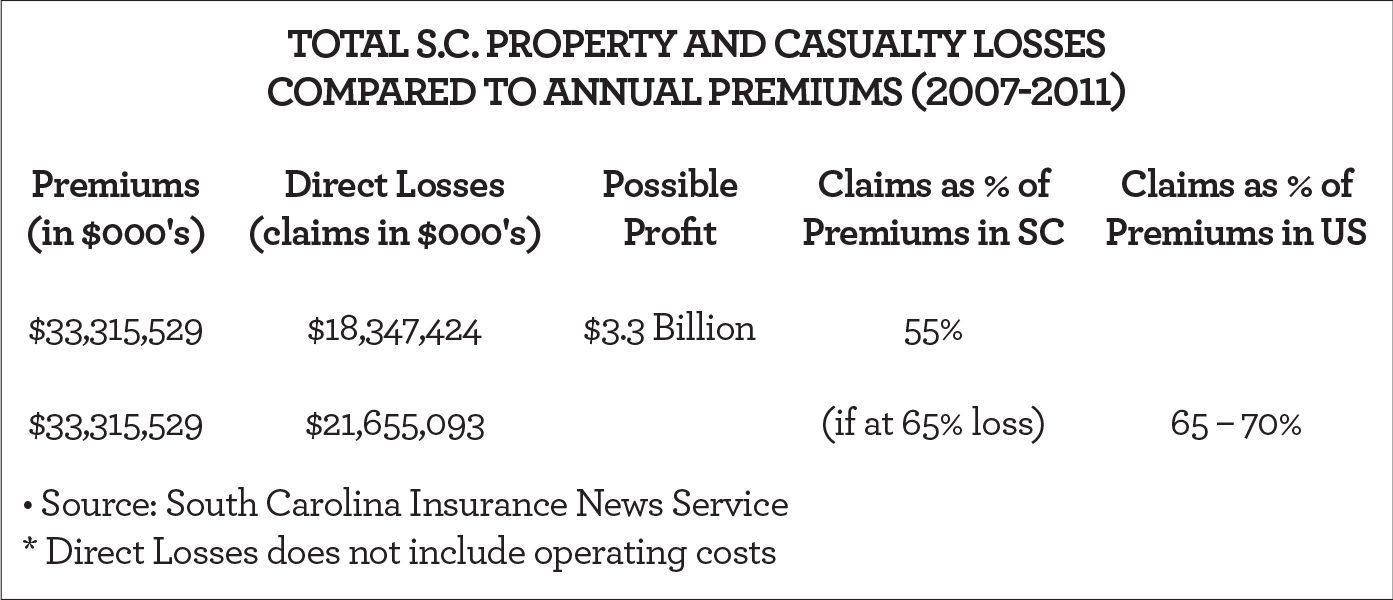

A half billion dollars is significant. But remember, we are only looking at homeowners insurance. The Department of Insurance is responsible for regulating the entire portfolio of property and casualty insurance. That includes auto, homeowners, and workman’s compensation insurance. We need to ask this question: If the D.O.I. (Department of Insurance) is not regulating homeowners insurance, how well are they regulating the entire portfolio of casualty insurance? South Carolina insurers wrote homeowners, auto, and workman’s compensation policies that totaled $33.5 billion dollars for the period of 2007 through 2011. For that period the insurance industry had “direct losses, or claims,” that averaged 65-70% of the premiums written throughout our 50 states. However, they only reported losses of 55%, or $18.3 billion in South Carolina. If the industry had reported an “average” state loss of 65% in South Carolina, they would have had a loss of $21.6 billion. In other words, the insurance industry either had abnormally low direct costs in South Carolina during the last five years… or they received abnormally high profits.

South Carolina doesn’t have a small insurance problem. It appears that we have a 1 to 3 billion dollar insurance problem. If the insurance industry had operating costs of, say, 1.5 billion dollars during that period, they still would have made 1.5 billion dollars more profit than the average state selling the same amount of insurance. The attached chart tells the story.

There’s a $3.3 billion dollar difference between what the average state pays out (i.e. claims paid to premiums) and what the South Carolina taxpayers paid to the insurance industry. We do not believe South Carolina has above average claims for a coastal state. In fact, we know that our hurricane risk is considered “relatively low.” So, is it possible that much of that $3.3 billion represents an unusually high profit for the insurance industry?

The Charleston Post and Courier led us to the answer. By August of 2011, I had enough data that clearly said we have a significant homeowners insurance problem. And I had a good idea why. As a businessman, my first thought was to take my findings to the source of much of the problem – the Commissioner of the Department of Insurance. I tried for three months to get an appointment. No luck. In the back of my mind was one question: “Why can’t I get an appointment with the Commissioner of Insurance when there is a possibility that we can save the state’s taxpayers $500 million to $1.5 billion dollars?” I was not going to wait six months for a state bureaucrat to get back to me. This problem had to be exposed to the full daylight.

In late February, 2012, I placed a call to William Hawkins, publisher of the Charleston Post and Courier, the state’s largest newspaper. After sharing my research with him for ten minutes, he said, “Mr. Ferguson, we need to get together. You don’t have to come to me. I will come to you.” The next week, he did. Hawkins brought his executive editor Tom Clifford with him. After two hours of discussion, Bill Hawkins turned to Tom Clifford and said, “I believe this story deserves our best investigative resources. Let’s put Tony on it.”

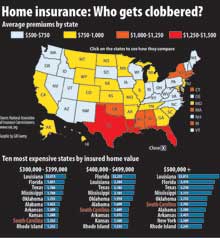

I had no idea what that statement meant, but I soon found out. Bill Hawkins had just put the newspaper’s best investigative reporter on the project. Tony Bartelme is not just a good investigative reporter; he is a Pulitzer Prize finalist. For ten months, watching Tony work was like watching a scientist trying to find the cause of Parkinson’s Disease. He did more than dig deep. He connected the dots. The newspaper hired an independent simulation company to test my conclusion that our coast had a “relatively low hurricane risk.” They concurred. By the time they issued their first “Storm of Money” article in June, Tony had uncovered the fact that South Carolina residents pay among the nation’s highest homeowners premiums. By the end of summer, he had made contact with an independent insurance guru who had also been the Commissioner of Insurance for Texas. Bob Hunter was currently working for the Consumer Federation of America as an insurance expert. Hunter knew the numbers. By August Tony had introduced Andy Twisdale and me to Bob Hunter. Andy is the Chairman of the South Carolina Competitive Alliance, a spin-off group that quickly recognized that our high homeowners insurance rates are beginning to negatively impact our ability to draw retirees to South Carolina.

Bob Hunter then revealed a very important study that he had quietly published in early 2012. He titled his report, “The Insurance Industry’s Incredible, Disappearing Hurricane Risk: or How Insurers Have Shifted Risk and Costs Associated With Weather Catastrophes To Consumers and Taxpayers.”

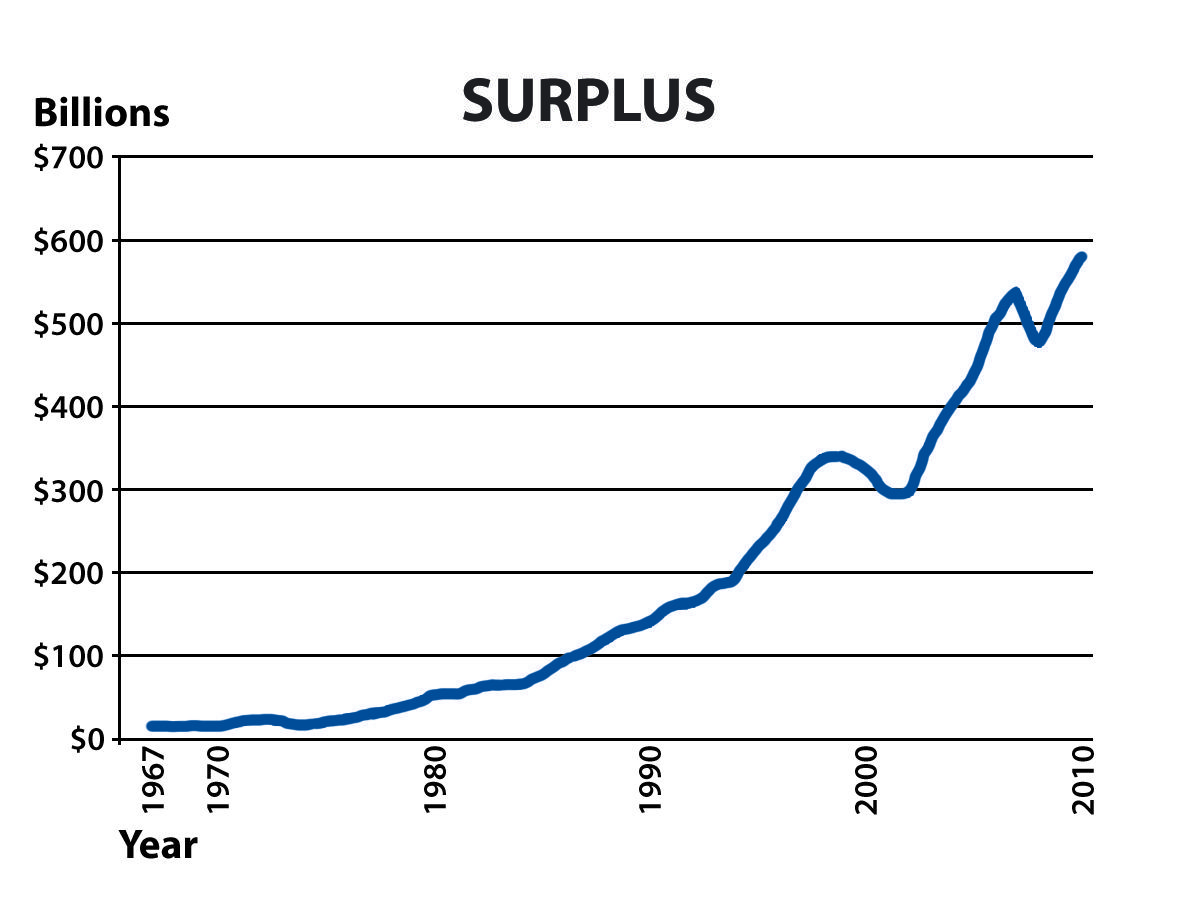

Hunter’s report was a bombshell. It began to further explain a second reason why our insurance rates are so high in South Carolina. Hunter had strong evidence that the insurance industry has been changing its strategy from “risk-taking” to “risk-avoidance” over the last few years. Furthermore, he showed that while the industry has reduced their insurance benefits and claims, they have simultaneously increased their premiums. How do they do this? They impose deductibles of 2 or 5%. That reduces their claims. They put a cap on claims allowed. That reduces their claims. They eliminate certain coverage… like mold. They write policies to cover your home at, say, a value of $400,000. But when the economy drops your home value by 40%, they don’t reduce your premiums. And they cancel any homeowners insurance policy that might have some risk. Simultaneously, says Hunter, the insurance companies have been aggressively raising their rates, while they have been reducing their benefits and their claims cost.

What’s the net result of this new insurance industry strategy? The answer is accelerated earnings. Higher earnings increase each insurance company’s assets. And higher assets increase their capital SURPLUS, which is the difference between ASSETS and LIABILITIES. Thus, the term SURPLUS really defines a company’s current wealth. As the following charts show, the insurance industry’s SURPLUS has risen from $300 billion dollars in 2000 to almost $600 billion in 2010. This is solid evidence that the industry is making a higher and accelerated profit.

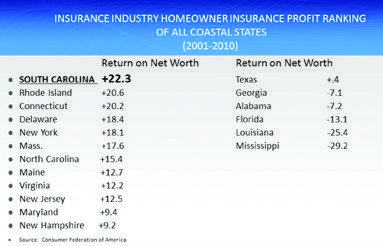

Bob Hunter’s research also showed what price South Carolina’s taxpayers are paying for the state’s poor regulation of homeowner’s insurance. He compared the profit (i.e. homeowner insurance return to net worth) that the insurance industry has made in each of the nation’s coastal states. The following chart tells the story. The insurance industry made an average profit of 5% on homeowners’ insurance for the average coastal state. They made a 22% profit in South Carolina for the last ten years (2000-2010). That’s not a high profit. It’s an obscene profit.

What the Post and Courier’s research shows us is that the coastal taxpayer is experiencing a double barrel impact on our insurance rates. First, the state is loosely regulating our insurance rates. They have literally created an “open door” for rate increases. But at the very same time, the insurance industry changed their strategy. They went from charging us so that they would take some risk, to increasing their prices while reducing their risks. They made this change without telling us. And the Department of Insurance was so badly managed that they had no idea of the change.

I am not a writer. I am just a businessman, husband, and father. Businessmen don’t shy away from problems; they often turn into big opportunities. But it has been very disappointing to see a state that is sometimes led by people who are afraid to address critical problems. On the other hand, it has been very motivating to see South Carolina leaders such as Andy Twisdale, Stu Rodman, Gary Kubic, Terry Ennis, David Ames, Senator Tom Davis, and Larry Rowland stand tall and say, “We can turn this dried flower into a beautiful rose.”

One of those leaders is P.J. Browning. Last fall Bill Hawkins retired as Publisher of the Post and Courier. He was replaced by P.J. Browning. Ms. Browning could have easily canceled the “Storm of Money” series which focused on our state’s insurance crisis. She did not. Instead, she continued to light a fire under her editorial staff to dig deeper. At the end of 2012, the news story that registered the most response from on-line subscribers was “Storm of Money.” By January of this year the Post Courier, and their investigative reporter Tony Bartelme, were nominated for a Pulitzer Prize for 2012.

Footnote: The Post and Courier series “Storm of Money” is a must-read. You can access it at www.postandcourier.com/storm-of-money.

Next issue:

What it takes to nominate an insurance lobbyist as our next Commissioner of Insurance. Senators Tom Davis and Vincent Sheheen lead a bi-partisan effort. Where is the governor?

Read Billion Dollar Coastline: Part One