Part 7: What Will It Take?

The Post and Courier’s headline banner for their Easter Sunday newspaper did not focus on Easter eggs, national news, or a train wreck. The Sunday headline banner read, “OUTRAGE OVER HOME INSURANCE.” The Gazette/Packet reprinted the article the following Tuesday. In that article Tony Bartelme, the Post and Courier’s Pulitzer Prize finalist, summarized the fact that coastal homeowners are literally going viral on their escalating homeowners insurance premiums.

The Post and Courier’s headline banner for their Easter Sunday newspaper did not focus on Easter eggs, national news, or a train wreck. The Sunday headline banner read, “OUTRAGE OVER HOME INSURANCE.” The Gazette/Packet reprinted the article the following Tuesday. In that article Tony Bartelme, the Post and Courier’s Pulitzer Prize finalist, summarized the fact that coastal homeowners are literally going viral on their escalating homeowners insurance premiums.

The article starts by telling the story of Geraldine and Tony Luppino. In 2003, the Luppino’s built an exceptionally strong, hurricane resistant home on a piece of land that juts out into St. Helena Sound. They thought they had done more than build an ultra-strong hurricane resistant home. They believed that their insurer, Nationwide, would be a reasonable and dependable provider. The Luppino’s were wrong. Within two years, Nationwide made a new calculation of the value of their home. They increased the replacement value of their home from $583,000. To $1,540,000. And when the reassessment rises, the premiums rise. The Luppino’s asked the right question. “How is it possible for any insurance company to increase the value of a home by one million dollars in just two years?”

This would normally be one of those interesting “we-made-a-mistake” insurance company stories. But this type of story is no longer an exception. It has become the norm. From the letters I receive, this is the new norm: Homeowners are routinely:

• Receiving premium increases of 20-25%. But there is no justification for the increases.

• Having their deductibles raised by 2-5%, with no explanation. Limits are being placed on the replacement of certain claims.

• Having some features of their original policy dropped. The exclusion of mold is a common one.

• Having their policies dropped . . . without any reasonable explanation. The Consumer Advocate of South Carolina informed me that one of his neighbors had his policy dropped because, “his house needed to be painted.”

But there is an untold part of the Luppino’s story. It’s what the insurance companies have NOT done. When you and I signed our homeowners insurance policy, we agreed to pay a premium to insure the assessed value of our house. That was our contract. When the economy was better and our homes appreciated more rapidly, it was normal for our insurance companies to remind us. They would ask for a higher premium since they were insuring a more valuable structure. It made sense . . . unless it was an unreasonable increase, like the Luppino’s situation. But since 2008, our property values have dropped in a near free fall. Some of our coastal homes have dropped in value by 40% during the last five years. But I have not heard of one insurance company that went to its customers and said, “We are now reducing your premiums since your home has a lower market valuation.” Doesn’t this sound like a breach of contract?

Last week, the South Carolina insurance lobby visited the Post and Courier editors to say “get off of our backs.” That is not likely to happen, and for one reason: the newspaper did the same research that we did. The Post and Courier double-checked our research. Our coastal homeowners insurance rates are largely based on our risk for fall hurricanes. About 70% of the projected cost of homeowners insurance is based on our hurricane risk. The Post and Courier knows that the coastal hurricane risk from Charleston to Savannah is “relatively low.” They also know that the coastal hurricane risk from Charleston to North Carolina is only slightly higher. That’s not a guess. It’s a fact that has been checked with both the National Hurricane Center and two major catastrophe simulation companies that serve the insurance industry.

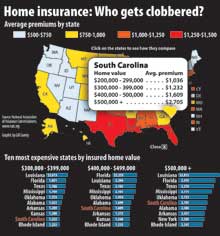

We also know that, for the last eight years, our Department of Insurance had no idea what our coastal risk was. Thus, is it any surprise that the Post and Courier discovered that over the last ten years, the insurance industry has made their largest profit, an obscene 20% return on net worth, in South Carolina? And is it any wonder that we pay among the highest homeowner premiums in the country?

But there is a second major reason why our coastal insurance rates have soared in South Carolina. Robert Hunter is the independent insurance expert on the staff of The Consumer Federation of America. He was previously the Commissioner of Insurance for Texas. Hunter believes that the insurance market has also changed its strategy. By increasing their deductibles and reducing their coverage benefits, Hunter believes that they have transitioned from “taking risks” to “avoiding risks.” Couple that “quiet” change to the fact that the Department of Insurance has not regulated homeowners insurance during the last eight years. The end result is obvious. South Carolina gives the insurance companies an unbelievable 20% profit. And, that’s a 20% profit with a declining risk! Thus, we know one thing. The “effective” profit that the insurance industry has made over the last ten years is really not 20%. It is much higher.

This issue has now become viral . . . not just because of what it’s costing each of us. It is also starting to impact the real estate market. Recent and prospective retirees are increasingly eliminating our coastal counties as a retirement destination. Our homeowners insurance is just unacceptable. The insurance industry has responded to all this with a stepped up lobbying effort. It’s a strategy that says, “Delay any action as long as you can because we are making a huge profit.” I know this strategy, because I saw it from the inside when I was president of Citizens Utilities. The insurance industry is trying to “manage” this situation. When the Post and Courier started its ‘Storm of Money’ series last summer, the insurance lobbyists responded by writing letters to the newspaper that focused on our fear of hurricanes. Their message was simple: “If you put pressure on your insurance company, they might leave the state.” Or they would suggest: “We need higher priced premiums, because another big hurricane could strike us.”

The insurance industry would be foolish to use these arguments again. No insurance company is going to leave its most profitable state. If my vice president of Regulatory came to me and said, “Daryl, South Carolina has ordered us to lower our homeowners insurance premiums by “X” percent, my answer would be this: “Well, we have been very fortunate to have had this honey hole for so long. We knew that this day was coming. Let’s comply and see what we can do in our rate structure to be more competitive.”

The insurance industry can no longer answer by saying that our rates need to be high because another major hurricane might hit us. This is another empty argument. The insurance company’s lobbyists may not know that our rates are based on our coastal hurricane risk. And they may not know that our coastal hurricane risk is “relatively low.” But, believe me, their top management knows. I know this because I have talked with them. And they also know that they are making their highest profit in the nation from one state – South Carolina.

We are in a situation where the insurance industry is trying to protect their honey hole. Their strategy is obvious: Appoint a “friend of the industry” as the next insurance commissioner. (Governor Haley recently appointed Ray Farmer, former senior insurance lobbyist, as Commissioner of Insurance.) They will blanket the legislature with their tilted messages. One state senator told me he understands that the industry has assigned a dedicated lobbyist to each senator.

Legislation does need to be passed to help turn the tide. Senator Tom Davis’ initial bill is a start. But it is not strong enough. Tom knows this and he is digging into the issues and working well with his Democratic associates and the South Carolina Competitive Alliance, headed by Andy Twisdale.

But is this enough? Absolutely not. Big problems require big solutions. They also require immediate solutions. What should be done? We can ask the Inspector General to convene a formal hearing. That would require an independent review of the D.O.I.’s rate of return models. A special task force could be assembled to determine if the industry has overbilled us ¬– and by how much. The state’s attorney general could file a class action suit against the major insurance companies for “breach of contract.”

We are facing a huge problem with a formidable opponent – the insurance lobby. You and I cannot afford to sit on the fence. We need to contact our legislators and push for action. We need to show our children and grandchildren that it takes a lot more than talk to make real change. They need to see us act.

IN THE NEXT ISSUE

We print your comments . . . your thoughts and your ideas about how we can turn around our insurance crisis.