By Bill Rauch

The good news is the proposal says that the city’s leadership has woken up to the scary fact that violent crime is now rising faster in Beaufort than in any other nearby jurisdiction. Beaufort’s police officers are now responding to three times more calls per shift than they did 15 years ago, leaving them no time to do the proactive policing work known as “community policing” that law enforcement professionals agree is necessary to keeping cities safe. The proposal says the city would hire more police officers if it could find a way.

If that’s good news, that’s the good news.

The bad news is that for a modest revenue boost the measure places into jeopardy the preeminence of the city’s commercial tax base.

The money machine

The term “commercial tax base,” as I use it here, means the combined revenues the city derives from the business license tax, the accommodations tax and the meal tax. At 37 percent of the city’s total revenue pie, this money machine is the envy of every government for many miles around. Beaufort’s commercial tax base is a machine that has been in development for two centuries here while Beaufort has consolidated its position as northern Beaufort County’s “downtown.”

Being the area’s “downtown” means the business sector substantially supports the City of Beaufort’s operations, thus lifting a heavy load from the property tax that in most communities carries the load. In Beaufort only 24 percent of the city’s operating budget is provided by the property tax. Beaufort’s commercial tax base is why Beaufort’s property tax millage rate is substantially below, for example, Port Royal’s, where the numbers are approximately reversed. Forty percent of Port Royal’s revenues come from the property tax and just 18-20 percent come from Port Royal’s businesses, according to Town Manager Van Willis.

But nothing except their proximity to one another keeps Beaufort’s businesses in Beaufort.

Port Royal and Lady’s Island would be delighted to have Beaufort’s schools, churches, medical facilities and other institutions. And if the public safety fee were to be imposed, that’s where they will start to go.

Take the jail. What good’s a jail, right? Well, Beaufort’s jail brings with it a courthouse, that brings with it lawyers’ offices that pay lots of property and business license taxes. Did I mention the half dozen bail bond services too? That’s just the beginning. It takes a lot of people to operate a jail. Each of them gets a meal or two, fills up their gas tank, and buys a few things to sustain the family on each of their shifts.

Or the United Way. They’re tax-exempt. So they’re expendable, right? The word on the street is the city’s buying their Boundary Street property so they can raze the building. Nothing lost there, right? Wrong. The hundreds of meetings that go on in the United Way building in a year help support dozens of city take-out and eat-in prepared food purveyors who pay property taxes, business license taxes and meal taxes. The United Way’s employees and contractors get their cars fixed and buy their groceries and gas and pick up their kids at the day care and their clothes at the dry cleaners on the way home from “downtown.”

To paraphrase former State Representative Harriet Keyserling, who started the Northern Beaufort County Arts Council a couple of times, when the non-profits go, they will take the city’s conscience with them. That’s not all they’ll take. Over time parts of the city’s service and retail sectors will inevitably splinter off and go too.

The city’s commercial tax base is a finely-tuned machine. If parts are taken out, it will start to sputter.

So … where’s the beef?

The silly “public safety fee” discussion arose when City Council was told by the city’s staff that the city is facing a $700,000 shortfall in their upcoming (FY’16) budget. Apparently, this group’s natural reaction to that news was to run around looking for new revenues, thus bringing renewed legitimacy to the state legislature’s successful efforts in recent years to rein in tax-happy localities by using state law to place caps on the localities’ various revenue sources.

But there’s another way. And before it’s too late, it’s time to get back to it. Council members should sit with the city manager and the finance director and go line-by-line through the city’s budget asking at the end of each line, “Do we really need this?”

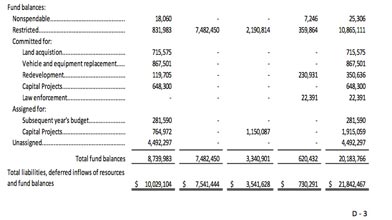

Let’s start on page D-3 of the City’s FY 2014 Comprehensive Annual Financial Report.

Last year City Council set aside $715,575 for land acquisition, but it is now clear the city’s not going to spend it. They have walked away from the Lipsitz House on Bay Street. The land that interests them is out on Boundary Street (including the United Way’s building) and the city intends to use TIF II funds to buy it, its most recent capital plan suggests. Rolled into the upcoming year’s budget, therefore, the land acquisition money closes the city’s FY’16 gap.

That’s just the beginning. In last year’s budget the city committed $867,501 to “vehicle and equipment replacement.” But of that, just $281,590 is expected to be spent. So that leaves $585,911 committed but unspent.

Then there’s the $648,300 the city committed to capital projects. Just $277,700 of that will be used this year. So there’s another $370,600 left over on that line to be rolled forward. Added in with the vehicle and equipment surplus, there’s the money for seven new hires in the Police Department at $123,460 apiece (salary, gear, fringes and car).

The reader may say, “Hey, that’s too easy. That’s got to be the reserve money you’re spending there.” Well, no. The reserve shows up on the unassigned fund balance line: there’s $4,492,297 set aside there for unexpected emergencies and to keep cash flow steady before the taxes come in.

For a city with a $17.5 million operating budget – and taxing authority — $4.5 million is a perfectly respectable savings account. The city’s bond rating is safe there.

Or, a seasoned budgeter may say, you may be able to hire the seven cops this year, but what about paying them next year? Two things: we can’t afford not to get back into community policing, and let’s get the general fund out of the land acquisition business until public safety is back under control. Pretty vistas aren’t worth peanuts if the streets aren’t safe.

Nothing, not economic development czars, nor commerce parks nor established businesses nor the city’s essential non-profit groups will reach their potentials until the public’s safety is restored.

Sure, this is a rough cut at the FY’16 budget after a couple of emails back and forth with Kathy Todd, the City’s Finance Director. I don’t doubt there’s a better way to achieve these goals, and as voters and taxpayers we expect City Council to find it.

A reporter, publisher, ghostwriter and author, Bill Rauch was the mayor of Beaufort from 1999-2008.