A friend of mine is a successful independent financial planner and an avid student of money and how it works.

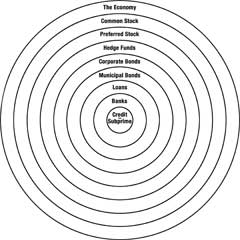

Recently, he attended a by-invitation-only session in DC that included cabinet-level participants, and he shared the concentric circles (above) as a way of explaining how we got where we are and what it will take to recover.

At the core (innermost circle in the diagram) of the recession we are so enjoying in America, are credit and the mammoth, ugly, subprime catastrophe that greed, stupidity, lack of control and mismanagement begat.

Once that foul soup in the inner circle started to boil over and seep out, the fallout poisoned, in distinct and precise order; the banks; their ability to make loans; municipal and then corporate bonds (both elementally critical to banks having money to lend); then, hedge funds, preferred stocks and common stocks (the key modalities by which significant institutional, corporate and ordinary investors participate in the market and last but certainly not least, the economy itself.

Let’s use one of the best illustrations, the Lehman Brothers example: They were a $20 billion company that reached a leveraged value of $800 billion in 2007!!! They took their surplus capital and invested into the subprime market to turn a higher profit (heck, so many did). Being risk averse, they only had a 3% exposure. This meant that they had an exposure of $24billion. When the available credit dried out with the subprime meltdown, they were left with an investment that had to be written off. Our current tax laws (since Enron) required that this $24 billion dollar loss be taken immediately and not deferred. So, the $24 billion had to be written off. Since Lehman only had $20billion in cash in the first place, they were now $4 billion in the hole and had no alternative but bankruptcy. This is how a massive company can suddenly become worthless. Keep in mind that if this was 1998, with different tax laws, we may never have seen this happen. But it did.

Look back up at the concentric circles and see just how predictable the pattern was and remains. Neither Lehman, nor AIG, nor GM, nor Chrysler nor your IRA nor mine had even a fighting chance against the ripple effect of these shock waves. Everything in the food chain was decimated.

That’s how it evolved; from the inside outwards and, according to my friend, here’s how the presenter at that august DC gathering said it would end: Exactly the opposite way it occurred in the first place.

The return of confidence in the economy, even in baby steps, will have the effect of strengthening common stocks, then preferred stocks and then the hedge funds. The relatively sustained rallies in the Dow and Nasdaq for the past eight weeks or so may be a sign of the beginnings of that reversal. So, as cash returns to the markets and hedge funds and then the bond markets, the ability of banks to borrow in order to lend will be enhanced and we’ll be on our way out of the recession.

Let’s hope it’s true. There are minor signs of recovery in some economic sectors but they sure aren’t yet visible in the housing market and for so many in our community whose lives are tied to real estate development, general construction and the building trades.

Far too many home sales are “short sales” (selling for less than what’s owed on them but more than they might get if they went to foreclosure), and while that may not be great for either the sellers or their lenders, at least it’s getting inventory out of the market and putting property into the hands of people who will be able to pay for it.

If you believe the loving, friendly and gentle ads the big banks are buying on TV these days, they are now “listening” to us and they want to “help.” Who knows, they may even actually be deciding to have sensible discussions with their customers who are in difficulty, instead of telling them that the only way they can help them is after they default on their mortgages or their loans or their credit cards! That seems like a really dumb way to do business.

If it’s true that what goes around does indeed come around, let’s hope we don’t enable a recovery that takes us back to that same way of thinking and of doing business that got us here. The “free” market cost an awful lot of people an awful lot of money. One of these days we are going to have to come to terms with where individual liberty meets the common good and remember that freedom still requires a little common sense.

What Goes Around Comes Around